Table Of Content

Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. Mobile home roof replacement costs $3 to $8 per square foot on average or $1,500 to $9,600 for a single-wide and $3,000 to $16,000 for a double-wide, depending on the material.

Fixed rate vs adjustable rate

If you’re getting a conventional loan with less than 20% down and will have to pay private mortgage insurance (PMI), try to minimize this expense. The larger your down payment and the better your credit score, the lower your PMI rate and the fewer years you’ll have to pay it for. What if you have a student loan in deferment or forbearance and you’re not making payments right now? Many homebuyers are surprised to learn that lenders factor your future student loan payment into your monthly debt payments. After all, deferment and forbearance only grant borrowers a short-term reprieve—much shorter than your mortgage term will be.

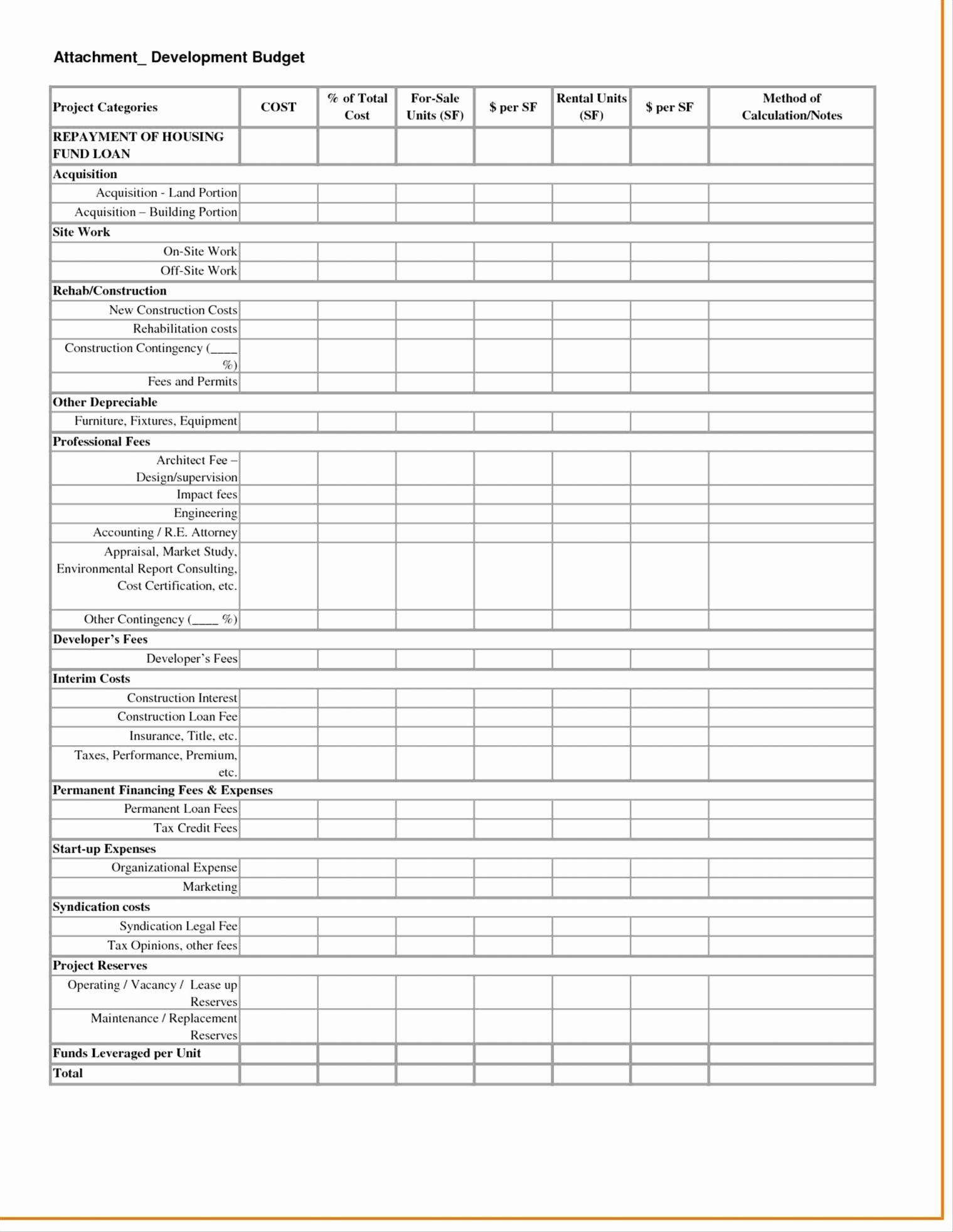

Timeline Tracking: Cost Per Phase (INR %)

Building your dream home in California means you'll need to consider all the necessary permits to complete the project, particularly if you want a pool or porch. Expect to pay $8,050 on average for a standard California landscaping installation project, or anywhere between $600 and $31,000. You'll want your new home to catch some eyes after it's all built, so you shouldn't leave landscaping out of the final cost. How much you'll pay depends on the size of your outdoor space and what you want to do with it, such as making it drought-resistant for drier parts of the state.

Average Cost to Build a House in California

Your down payment is subtracted from the total amount you borrow. Most people choose 30-year fixed-rate loans, but if you’re planning on moving in a few years or flipping the house, an ARM can potentially offer you a lower initial rate. Although there is no set time frame, the custom within the real estate industry is that mortgage pre-approval is valid for between 90 to 180 days. Make sure to ask your lender how long your pre-approval lasts, or look for this expiration date on your pre-approval letter.

For instance, if you want a lower monthly payment then you’ll want to choose a 30-year loan term. If you’re looking to pay less money in interest overall and can manage a higher monthly payment, you’ll want to choose a shorter loan term. You can also adjust the interest rates to see your payments based on market conditions or your credit score. You can expect to pay the lowest interest rate available if you have excellent credit. If you don’t have stellar credit, you can still qualify for a mortgage, but it might not be at the lowest rate.

A higher credit score will get you a lower interest rate, and the lower your interest rate, the more you can afford to borrow. While 43% is the highest DTI that borrowers can typically have and still qualify for a conventional mortgage, most lenders prefer borrowers with a back-end ratio of 36% or lower. Let’s say your car payment, credit card payment and student loan payment add up to $1,050 per month. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450. When it comes to your money, it’s never a good feeling to be caught off guard.

How much does a roof replacement cost?

Calculate Your Home Renovation Costs - NerdWallet

Calculate Your Home Renovation Costs.

Posted: Tue, 23 Apr 2024 16:08:11 GMT [source]

A mortgage term is the length of time you have to repay your mortgage loan. They can be either fixed, staying the same for the mortgage term or variable, fluctuating with a reference interest rate. A lump-sum payment is when you make a one-time payment toward your mortgage, in addition to your regular payments.

Should You Paint Your Home Yourself?

Homeowners insurance rates vary depending on where you live and the age and condition of the home. For instance, you may pay a higher premium for a home that’s older or hasn’t been properly maintained. When using a mortgage loan calculator, you’ll need to enter your zip code to receive an accurate estimate.

How much mortgage payment can I afford?

Down payment & closing costsNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features. The mortgage calculator lets you click "Compare common loan types" to view a comparison of different loan terms. Click "Amortization" to see how the principal balance, principal paid (equity) and total interest paid change year by year.

And you’re not alone—78% of homebuyers had to finance their home purchase in 2022, according to the National Association of Realtors. Before you get a mortgage, it’s critical to know how much home you can afford, especially as homes become more expensive. Using the Rocket Mortgage calculator is a good way to get started.

If you're planning a building project, we recommend starting as early as possible in the season, preparing for potential price fluctuations, and allowing extra time to order materials. First of all, this will depend on where you are looking to buy. While housing prices have jumped nationally, they can still vary widely in terms of affordability when broken down by local area. If you have a VA loan, guaranteed by the Department of Veterans Affairs, you won’t have to put anything down or pay for mortgage insurance, but you will have to pay a funding fee. Loan requirements for cash reserves usually range from zero to six months. But even if your lender allows it, exhausting your savings on a down payment, moving expenses and fixing up your new place is tempting fate.

You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. The calculator also allows the user to select from debt-to-income ratios between 10% to 50% in increments of 5%. If coupled with down payments less than 20%, 0.5% of PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional loans.

The average price to build a home in California is $500 per square foot. The average cost to build a house in California is around $1.35 million. This price is for an average 2,700-square-foot custom-built house and doesn’t include the price of the land. The average range for a house to be built in California will be anywhere from $1 million to $1.68 million. Depending on the home location, customizations, and style, you may pay anywhere from $400,000 to upwards of $2.4 million.

Homeowners insurance also provides liability insurance if there are accidents in your home or on the property. Both the upfront fee and the annual fee will detract from how much home you can afford. A financial advisor can help you create a financial plan for your home buying goals.

Refinancing requires a new loan application with your existing lender or a new one. Your lender will then re-evaluate your credit history and financial situation. Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. That’s a big deal, because mortgages backed by the Department of Veterans Affairs typically don’t require a down payment.

No comments:

Post a Comment